Really easy!

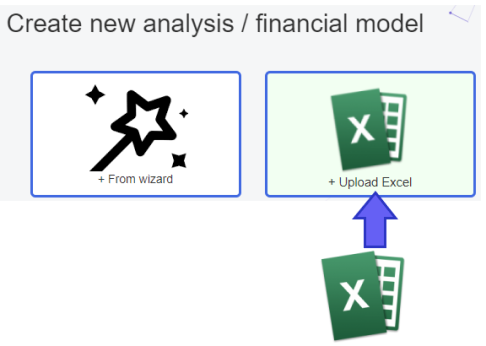

Simply upload your Excel and get a complete analysis!

Get access to all the user-friendly features.

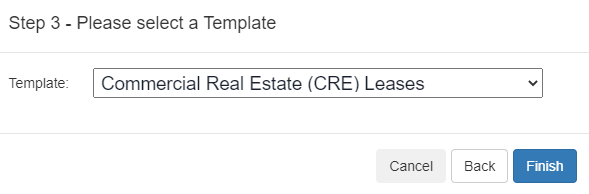

- Within the solution there are links to Excel templates.

- You can also input/edit directly in this web solution.

Free solution available!